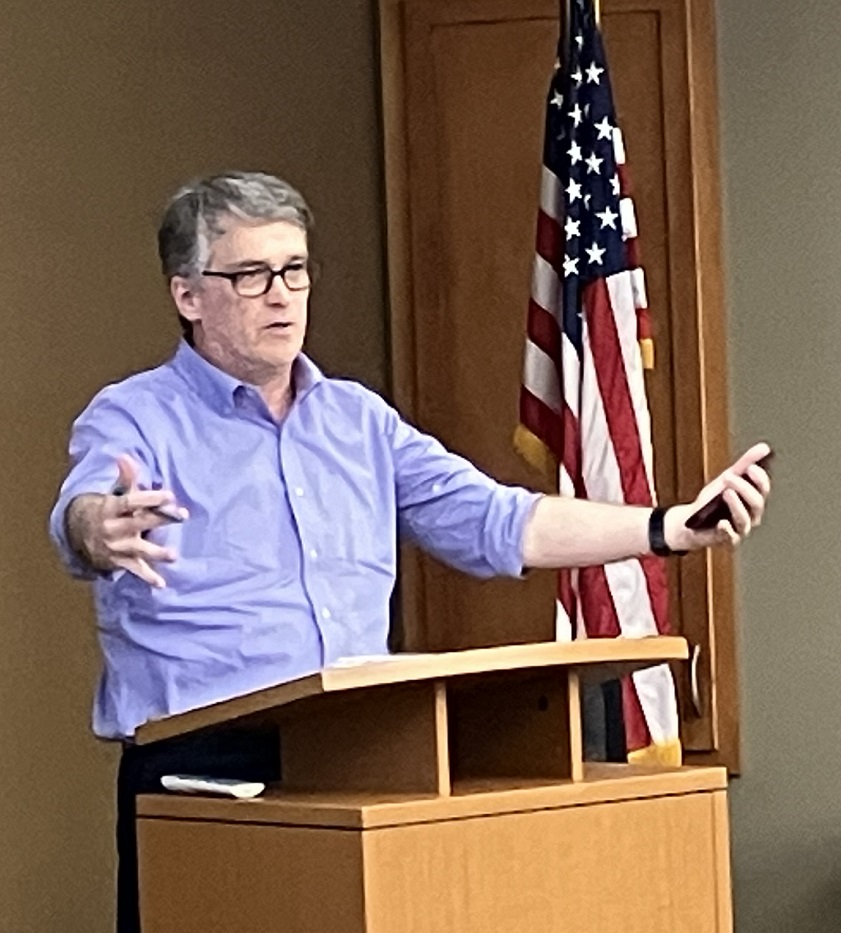

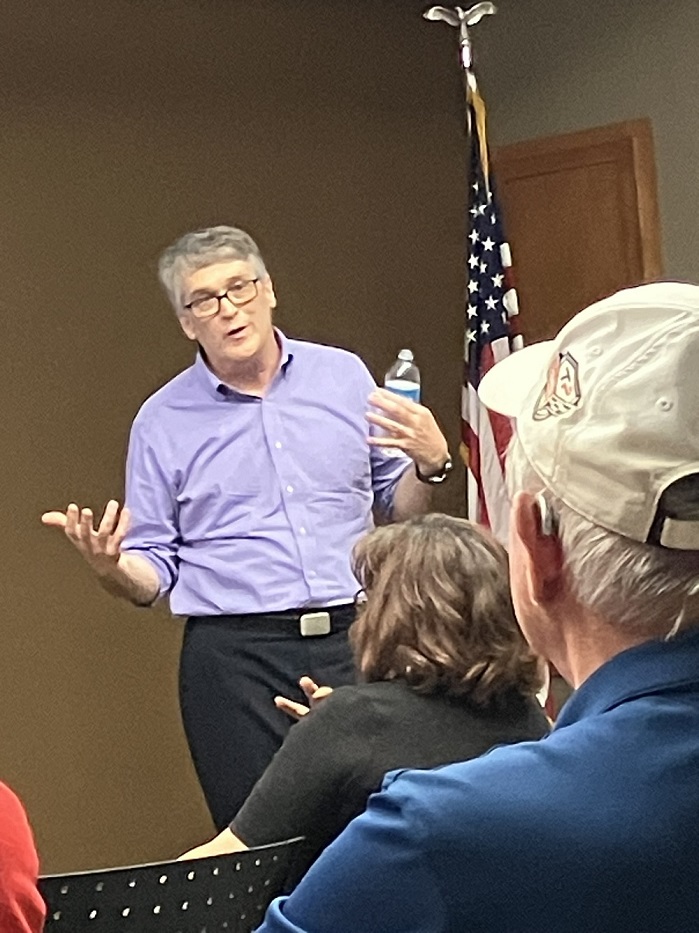

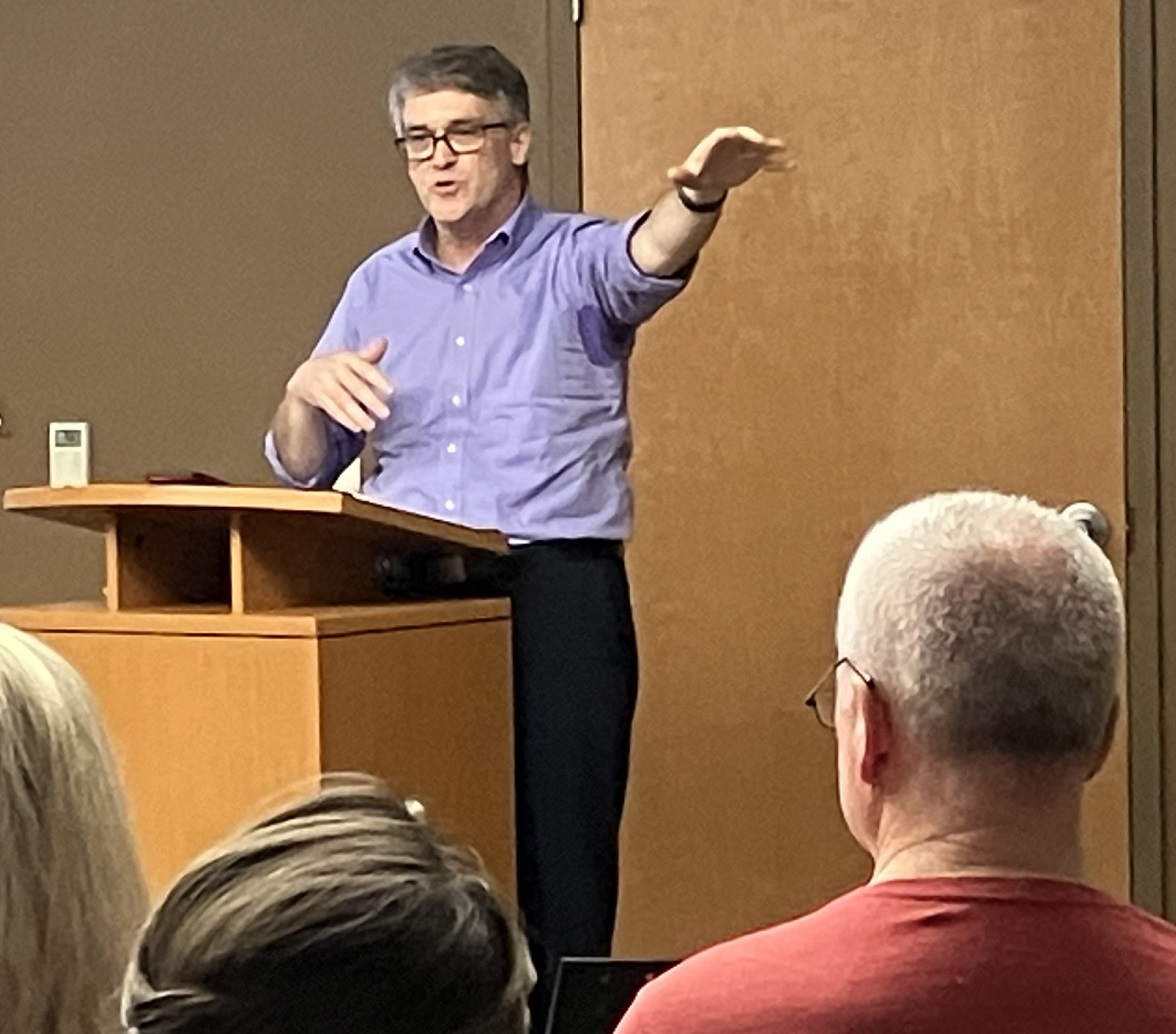

NEW Patriots’ May 9 meeting featured Brett Healy, president of the MacIver Institute. He walked us through discussions taking place in Madison over Gov. Tony Evers’ proposed 2023–2025 biennial budget, noting the budget discussion “is the big game in town right now.”

For the 2021–2023 budget, Evers proposed to spend $90 billion over two years. His current budget proposals seeks a 16% increase, to $104 billion. Healy noted Evers has sought average spending increases of $9.1 billion during his terms as governor, while former Gov. Scott Walker sought average increases of $3.1 billion.

Healy noted Evers is also proposing a tax increase of $1.75 billion – even though Wisconsin currently has a $7 billion budget surplus. He pointed out “there’s no such thing as a temporary government program,” noting the governor wants to continue funding things funded by the federal government’s ARPA (American Rescue Plan Act of 2021) program, which was meant to “get us through COVID.” The feds’ funding for those programs has ended, but Evers wants to continue them using state taxpayer dollars.

Healy provided roughly a dozen really good handouts for his presentation. Among them were The MacIver 2023 Agenda, which Healy introduces this way: “While the challenges we face here in Wisconsin are many, we believe the answer should never be more government or less freedom for you and your family.” We found especially useful his chart showing “2021–23 Budget All Funds Spending” by year, month, day, hour, minute, and second! Who knew the K–12 education system spends $233 per second?! Or that the state spends $406 per second on Medicaid?

The governor’s budget proposal is currently in the hands of the Joint Finance Committee of the state legislature. The committee “has ripped everything out of Evers’ budget and started at base,” Healy said. The Wisconsin Examiner reported on May 3,

The Joint Finance Committee (JFC) started its work crafting Wisconsin’s next biennial budget on Tuesday by removing hundreds of items from the budget proposed by Gov. Tony Evers including Medicaid expansion, the legalization of marijuana and paid family and medical leave. The motion passed 12-4 by the Republican-led committee on Tuesday stripped a total of 545 items from the budget, technically barring the items from being brought forth again during the process.

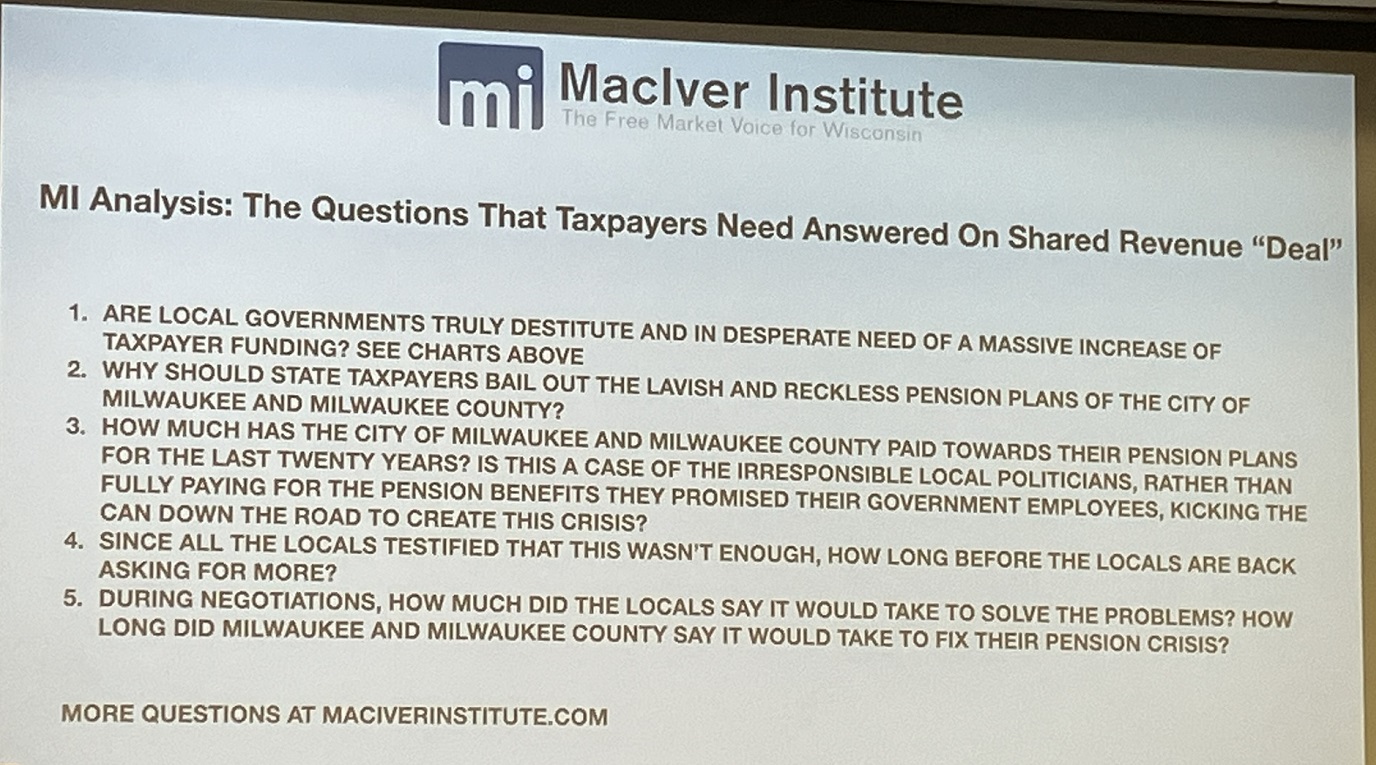

Related to the budget, Assembly Republicans have released a proposal to increase shared revenues – funds the state collects from taxpayers but then returns to local governments. While the current shared revenue program comes with no strings attached, the proposal would emphasize funding for funding for law enforcement, fire, EMS, public works, and transportation. Healy noted shared revenue fell 1.5 percent from 2001 to 2021, but many other sources of revenue for local government increased dramatically – leading him to doubt whether local governments are starving for revenue.

Concerning the $7 billion budget surplus Wisconsin currently enjoys, Healy briefly described MacIver Institute’s plan to use that surplus to fund the state’s transition to a 3% flat-rate income tax.

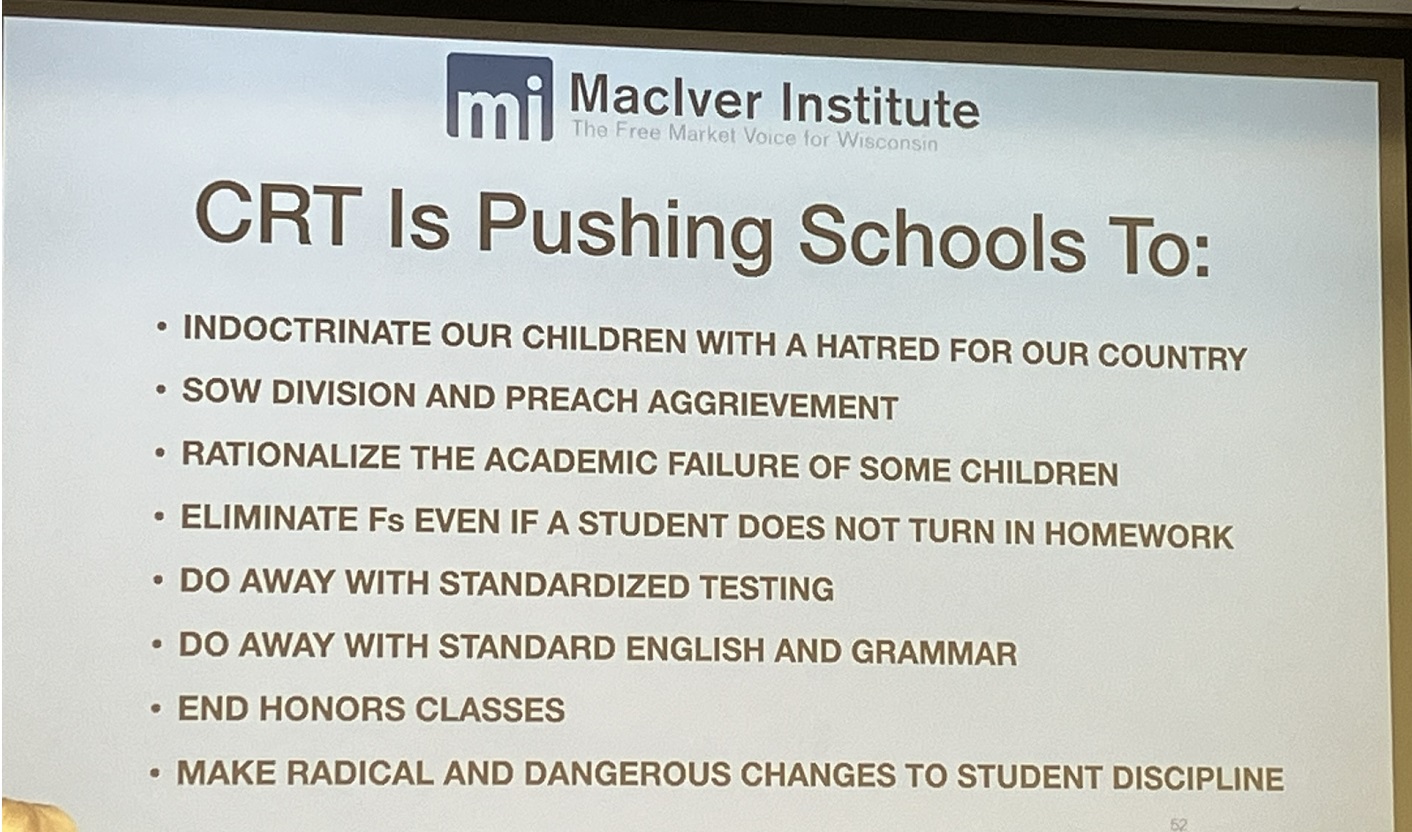

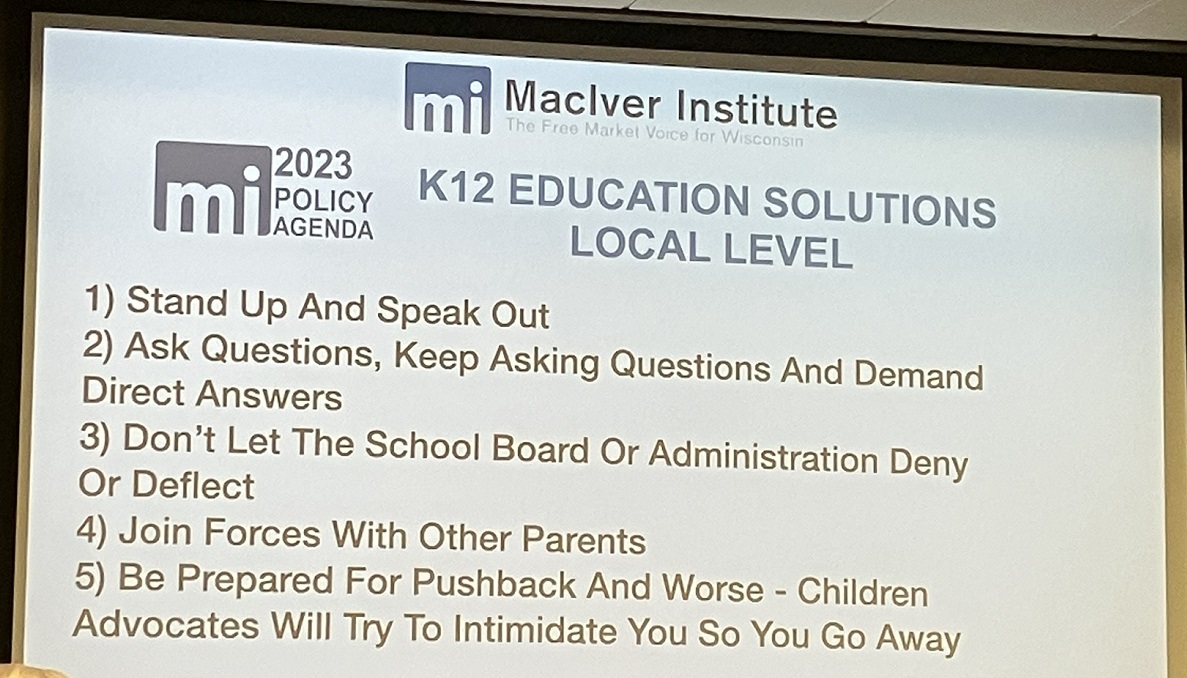

After winding up his discussion of the budget, Healy shifted gears into a discussion of K–12 education in the state. He noted student grade-level proficiency has fallen since 2017: in math, from 42.8% in 2017 to 39.3% in 2022; and in ELA, from 44.5% in 2017 to 37.0% in 2022. This despite the fact that enrollments have fallen (from 863,881 in 2017 to 829,143 in 2022) and state funding has increased (from $6.46 billion in 2017 to $7.53 billion in 2022). He also discussed Critical Race Theory, distributing three useful handouts:

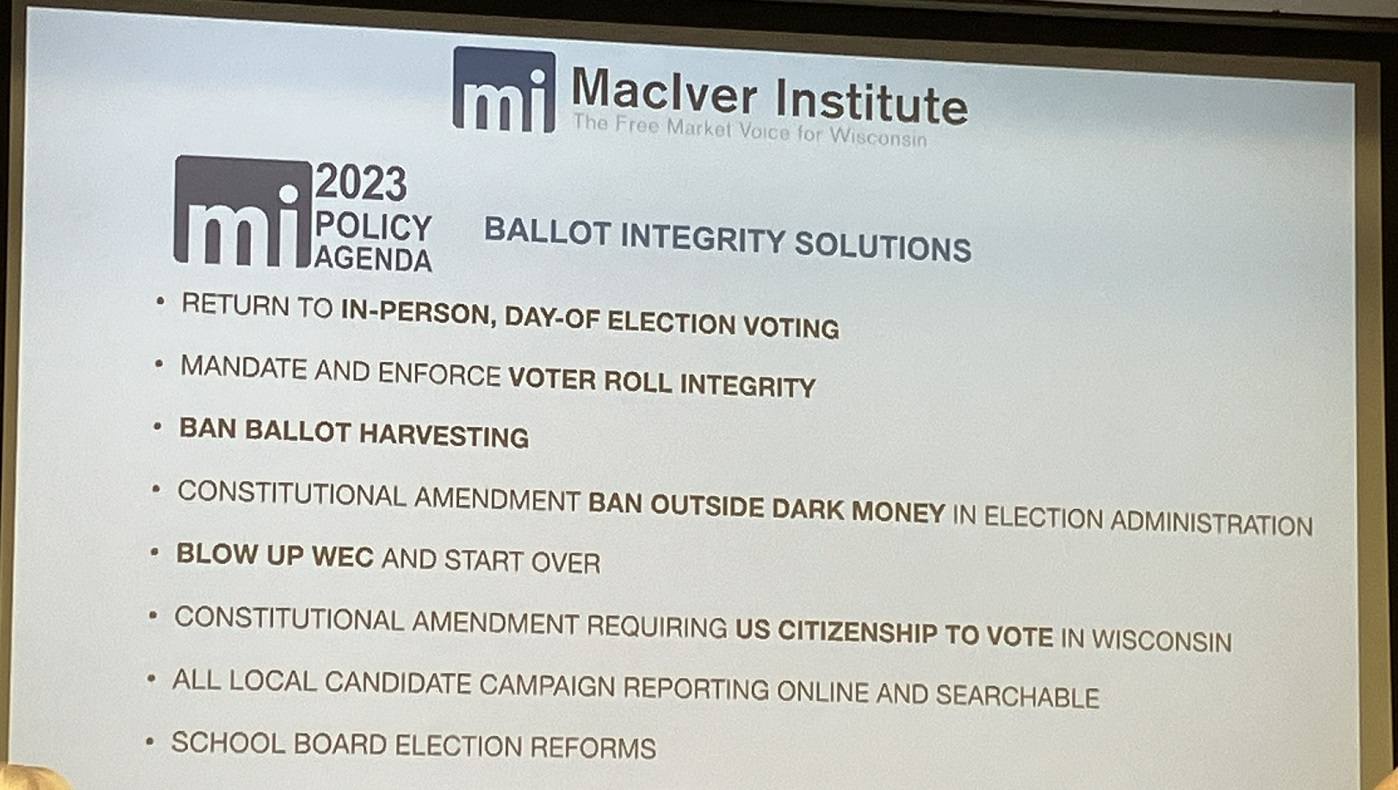

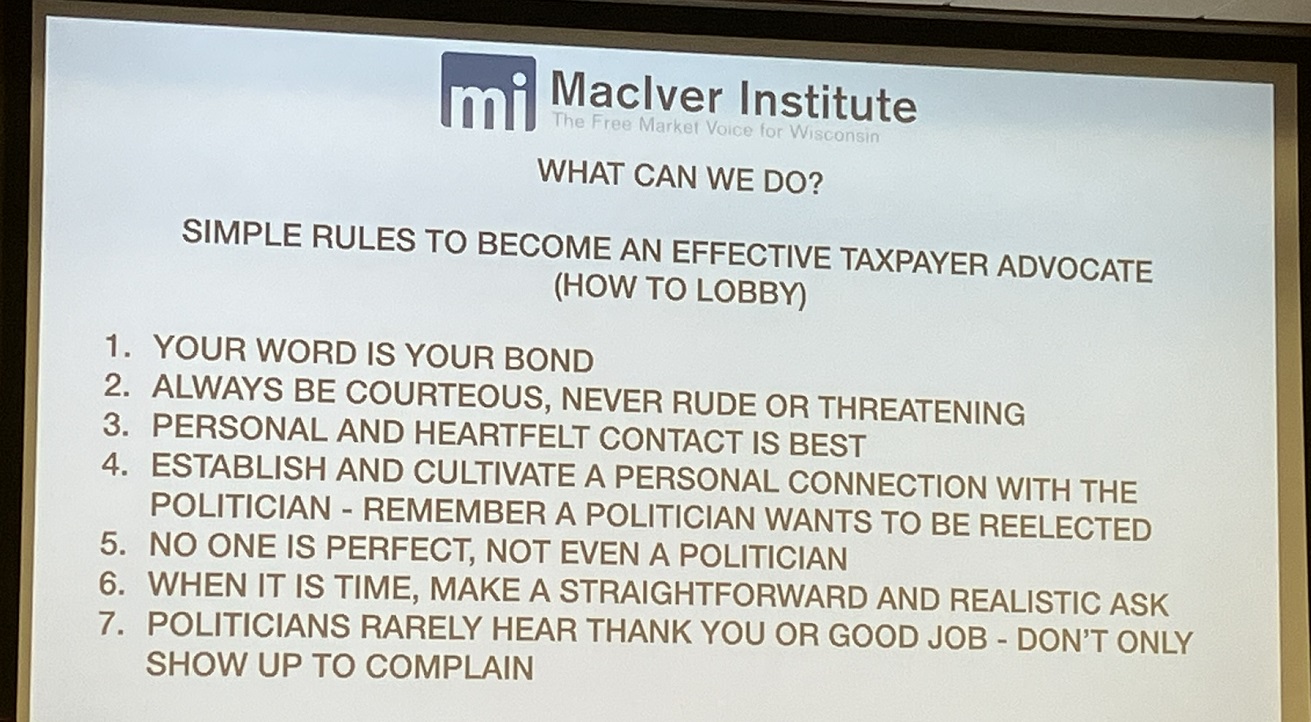

The photos below also show solutions MacIver Institute has offered for improving K–12 education and also for ballot integrity – a topic he didn’t have much time to discuss. He closed with “Simple Rules to Become an Effective Taxpayer Advocate (How to Lobby),” noting “just 10 calls in two days to a legislator will make a difference.”